Assume the following data for 2000. Cost and management accounting The entity is considering whether to abandon absorption costing and use marginal costing instead for profit reporting and inventory valuation.

Marginal And Absorption Costing Ebookskenya

Select the answer which best completes the statement.

. The variable cost per unit plus fixed costs and some of the profits. Marginal Costing Absorption Costing MCQs. A Absorption costing helps in preparation of fixed budget.

It will help the students to prepare. ACTIVITY BASED COSTING QUESTIONS AND ANSWERS. Your search results for.

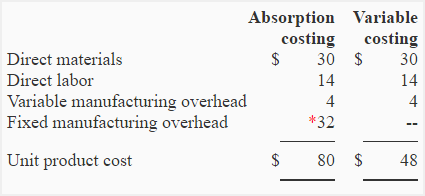

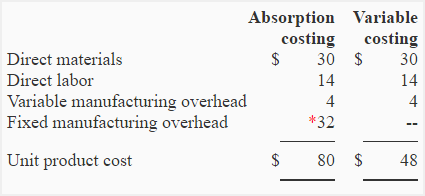

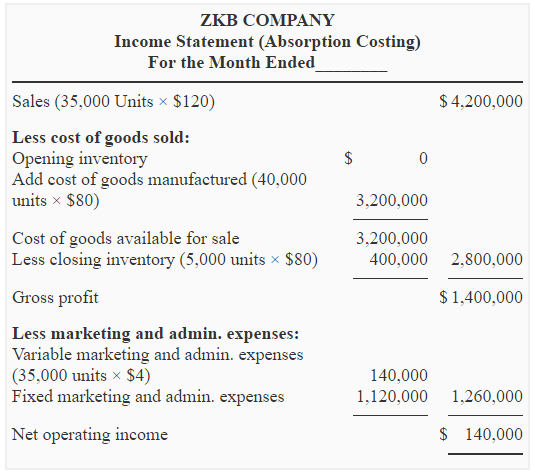

Latest Absorption Costing questions answered by industry experts. Exercise-1 Unit product cost under variable and absorption costing Exercise-2 Variable costing income statement Reconciliation of net operating income. Variable and absorption costing.

Or click on a link below. Manufactures a single product. Marginal and Absorption Costing Practice Questions Question 1.

The same as absorption costing. In other words it is the costing method mechanism that. A The term meaning that all manufacturing costs direct and indirect fixed and variable which contribute.

Cost of goods manufactured for the year. Question Marginal costing principles Mill Stream makes two products the Mill and the Stream. Variable costs per unit.

Selling and administrative 14. 0747 46 67 61. The value of the ending inventory of finished goods.

Multiple choice questions MCQs Number of MCQs. Bigeso Makenge PGDA TIA BBA UDOM Tel. A Calculate the full cost per.

B Absorption costing is dependent on level of level of output. The aim of absorption costing is recovery of full costs while marginal costing is concerned with recovery of variable costs alone. ABOUT THIS QUIZ.

Using the absorption method calculate the following. SE Asia Rubber plc is a new company which produces tyres for cars. This section contains multiple-choice questions and answers on Marginal Costing Absorption Costing.

Absorption costing is the costing method in which the fixed overheads of production are included in question_answer Q. Activity-Based Costing ABC is the costing that begins with the tracking of activities and then the output of the product. C Absorption costing is very helpful in taking managerial.

Total Absorption Costing Questions and Answers Test your understanding with practice problems and step-by-step solutions. Up to 3 cash back QUESTION 1. Surat is a small business which has the following budgeted marginal costing profit and loss account for the month ended 31 December 2001.

Approach of both is totally different. 24x7 Online Chat Support. What is absorption costing.

Browse through all study tools. SE Asia Rubber plc has a two year contract to supply a. The variable cost per unit plus a markup.

3 Marginal costing and absorption costing and the calculation of profit D4 b c. Explain the difference between the variable and absorption.

Chapter 9 Marginal And Absorption Costing

Problem 2 Variable And Absorption Costing Unit Product Costs And Income Statements Accounting For Management

Chapter 9 Marginal And Absorption Costing

Problem 2 Variable And Absorption Costing Unit Product Costs And Income Statements Accounting For Management

0 Comments